Support the future

Fostering Excellence in Education and Lifelong Memories

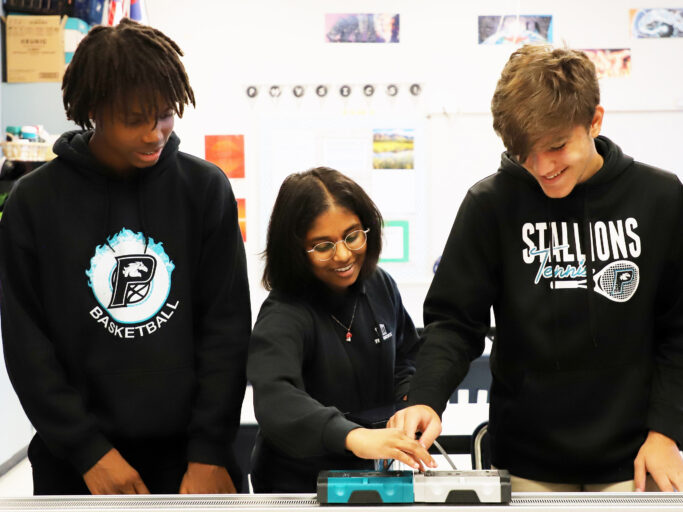

Providence students thrive in the classroom, as members of teams, on the stage and in the studio, and most importantly as they understand their purpose for eternity. Our graduates are courageous, compassionate leaders who are making a difference in the community around us and across the world. Your giving ensures the mission of Providence School and impacts every student and teacher each year directly as we educate boldly Christian, unquestionably academic servant leaders who change the world.

An Endowment for Our Future

Investing in Providence’s endowment is a sustainable investment in our financial future. You are providing resources that will create a legacy in perpetuity, ensuring that your gift today provides for generations of future Stallions to come.

Your tax-deductible giving, in partnership with other Providence parents, grandparents, alumni, corporate partners and fans, ensures the best for our students and teachers and that we create a lasting legacy of Christian education for future generations of Stallions. Please contact our Advancement team for more information.

We can’t sit back and expect future generations to know how to be generous. We must believe in a mission and get involved. Our children and grandchildren are such a blessing and it is an honor to be able to invest in their future through Providence.

Debbie rising, Grandparent